Lithium ion battery was born in the 1970s. After it was successfully commercialized by Japanese SONY Company in 1991, it has been widely used in power, energy storage and other fields. Ge Gaozhang understands the reasons behind the price rise and the impact it will bring

The raw materials of lithium battery mainly include positive and negative electrode materials, electrolyte, diaphragm, collector, etc. Among them, cathode materials are the most critical raw materials for lithium batteries, including lithium carbonate, lithium hydroxide, etc. Since 2020, the ex factory price of battery grade lithium carbonate has increased from the lowest 42000 yuan/ton to 95000 yuan/ton; The ex factory price of lithium hydroxide increased from the lowest 43000 yuan/ton to 90000 yuan/ton. What is the reason for the rise of lithium battery raw materials? This paper will analyze the reasons for the rise in the price of lithium battery raw materials and its impact.

Main listed companies in the power lithium battery industry: At present, the listed companies in the domestic power lithium battery industry mainly include Ningde Times (300750), BYD (002594), Funeng Technology (688567), Yiwei Lithium Energy (300014), Guoxuan High Tech (002074), Aoyang Shunchang (002245), Penghui Energy (300438), Xinwangda (300207), etc.

Core data of this paper: price of lithium battery raw materials, sales volume of new energy vehicles, and monthly loading volume of power batteries

1. The price of lithium battery raw materials rises

Lithium ion battery was born in the 1970s. After it was successfully commercialized by Japanese SONY Company in 1991, it has been widely used in power, energy storage and other fields. The raw materials of lithium battery mainly include positive and negative electrode materials, electrolyte, diaphragm, collector, etc.

Among them, cathode materials are the most critical raw materials for lithium batteries, including lithium carbonate, lithium hydroxide, etc. Since 2020, the ex factory price of battery grade lithium carbonate has increased from the lowest 42000 yuan/ton to 95000 yuan/ton; The ex factory price of lithium hydroxide increased from the lowest 43000 yuan/ton to 90000 yuan/ton.

2. The demand for power lithium batteries increases greatly

From the demand side, the sales volume of new energy vehicles in China from 2012 to 2020 showed an overall growth trend. In 2020, under the influence of the COVID-19, the sales of new energy vehicles still achieved a growth of 10.9%. Since 2021, the sales volume of new energy vehicles has increased rapidly. From January to April 2021, the sales volume of new energy vehicles in China reached 732000, with a year-on-year growth of 257.1%.

The rapid growth of new energy vehicle sales has driven the growth of power battery loading. In May 2021, China's power battery load will total 9.8 GWh, a year-on-year increase of 178.2%. With the growth of new energy vehicles' demand for power lithium batteries, power battery enterprises are in hot demand.

3. Shortage of supply is the reason for the rise of power lithium battery raw materials

While the demand has increased greatly, the supply of power lithium battery raw materials has exceeded the demand. The global lithium, cobalt and nickel resources are mostly concentrated overseas and are monopolized by the head mining group. Since 2020, affected by the COVID-19, raw material enterprises have failed to achieve the production expansion plan as expected, resulting in a shortage of raw material imports and tight supply.

4. Impact of raw material price rise

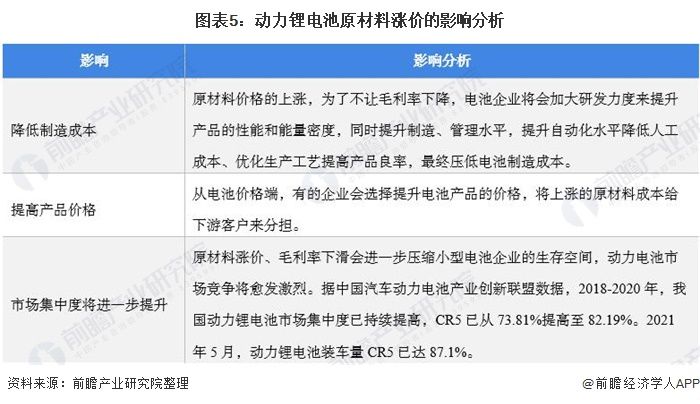

The most direct impact of the rise in the price of power lithium battery raw materials is that it will bring about a decline in the gross profit margin of enterprises. In order to meet this challenge, enterprises will choose two ways to maintain a reasonable gross profit margin, one is to reduce manufacturing costs, the other is to increase product prices.

In addition, for the power lithium battery industry, the rise in raw material prices and the decline in gross profit margin will further compress the living space of small battery enterprises, and the concentration of power battery market competition will further improve.

Related Developments

Related Developments

Solution

Solution